Start of the application period for the FNG-Label 2025

For the tenth time, asset managers now have the opportunity to apply their products for the SRI quality standard in the German-speaking market.

The application period for the FNG-Label 2025 begins on 04.04.2024 and ends on 07.07.2024.

IMPORTANT: Applicants who have already registered/applied, please log in with the existing account information.

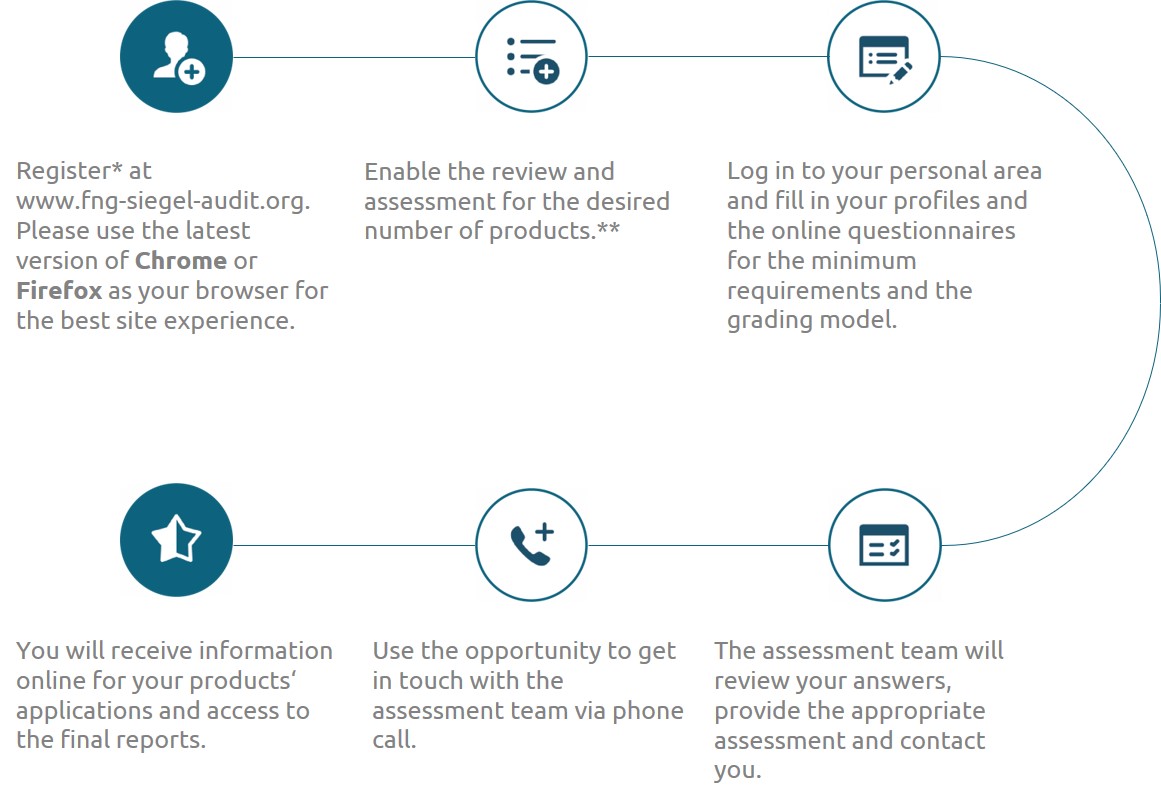

Important information

about the process

*Please fill out your profile completely during your registration so that we can match it accordingly. Please note that registrations without profile information cannot be processed.

IMPORTANT: Applicants who have already registered/applied, please log in with the existing account information.

**Please note that as soon as all submitted products have passed the minimum requirements, it is technically no longer possible to book/activate further products. Therefore, please have the desired number of products activated at the beginning of the review and assessment process.

Application period FNG-Label 2025:

04.04.2024 to 07.07.2024

Review and assessment process/feedback: until 11.10.2024

Award ceremony at the Römerberg in Frankfurt am Main: 28.11.2024

The FNG-Label

online platform

- Register at www.fng-siegel-audit.org and interact directly with the assessment team. Applicants who have already registered/applied, please log in with the existing account information.

- Structured and quick entry and transmission of your data thanks to a step-by-step online questionnaire.

- Save time when entering your data by transferring data from a reference fund.

- Secure handling of your data via encrypted servers.

ESG INSIDE: Information for product managers

Advertising sustainability is easy. Therefore, it is even more important to verify genuine quality and make it visible. Show investors and distribution partners at a glance that your sustainable products meet or exceed today’s expectations for sustainability funds.

The independent research and assessment is carried out by the non-profit academic association F.I.R.S.T. in conjunction with Advanced Impact Research GmbH (AIR) as a university spin-off. Prof. Dr. Timo Busch from the University of Hamburg is on the academic advisory board. In this context, F.I.R.S.T. bears overall responsibility, in particular for the coordination, awarding, and marketing of the FNG-Label. The review process is also monitored by an external committee with interdisciplinary expertise.

Requirements and

application documents

Sustainably managed investment funds or similar investment vehicles of all asset classes can apply for the FNG-Label, provided they comply with the UCITS or an equivalent standard and are authorized for distribution in at least one of the following countries: Germany, Austria, Switzerland, or Liechtenstein.

The Label requires the fulfillment of certain minimum requirements. To be awarded the Label, the product has to meet all minimum requirements. Candidates who apply for both the minimum requirements and the grading model may achieve up to three stars in the grading model signaling varying levels of quality. The number of stars awarded depends on the number of percentage points achieved in the grading model.

To be reviewed and assessed, the information for all the applicable requirements (minimum and grading model) must be submitted online by 07.07.2024.

As stated in the rules of procedure, the assessment team from Prof. Dr. Timo Busch has the right to request additional documents to verify the product’s compliance with the Label’s criteria.

FNG-

Sustainability Profile

The FNG-Sustainability Profile provides a brief overview of a fund’s sustainability information and supplemental data.

Examples may be found here. Depending on the fund the data may be available in English.

Further

Information

You should also download the rules of procedure before filling in the questionnaire to be able to better understand the Label criteria.

Should you require more detailed information about the application process, the application requirements, and the Label criteria, please contact us at fng-siegel-pruefung@air4p.org/roland.koelsch@first-ev.org or by phone at +49 178 5635724.

We would also be happy to visit your office to discuss the FNG-Label. Please contact us to arrange an appointment.

Explanatory videos

about the FNG-Label

FNG-Label Process

In this video, we summarise the entire process flow of the label with all relevant time frames and deadlines that are important for an application for our quality standard of sustainable investments.

FNG-Label Process

-Minimum Requirements-

In this video, we explain the labeling process and give you further information on the minimum requirements of the FNG-Label.

FNG-Label Process

-Grading Model-

In this video, we explain the procedure of the grading model. The grading model – as the voluntary part after the successfully completed mandatory part – gives you the opportunity to receive a higher award of up to three stars in addition to the minimum requirements.

FNG-Label Process

-Referencing-

In this video, we explain the feature “referencing“. We go into the basic idea behind referencing and show you how to use it in the Online-Tool.

FNG-Label Process

-Tips & Tricks-

In this video, we have summarised information and tips for you on how to fill in the form and specifically on the minimum requirements to enable you – and us – the assessment team – to have a smooth review and assessment process.

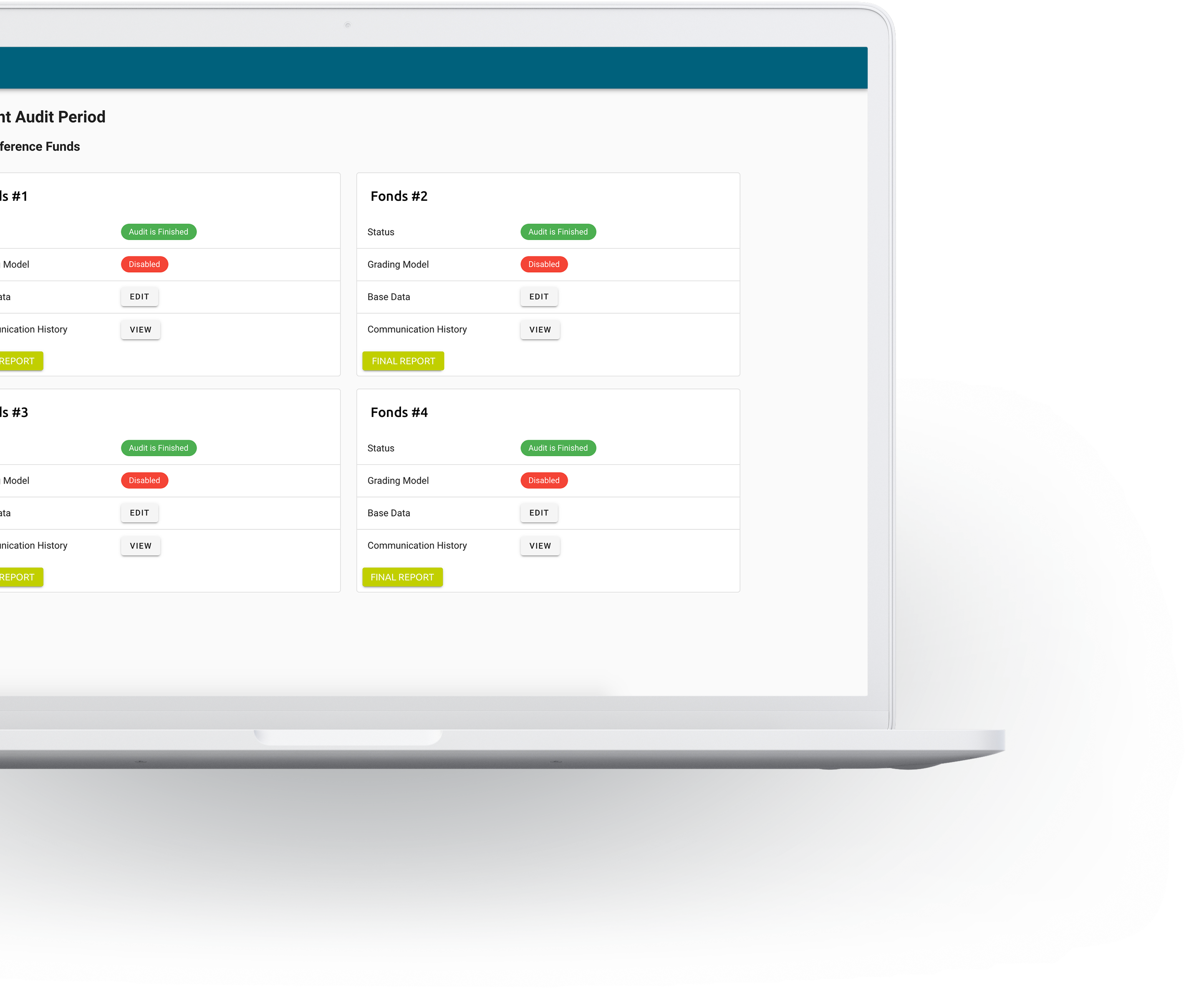

How does the

Online-Tool work?

In this video, we explain how the Online-Tool works.

FNG-Siegel

Der Qualitätsstandard für Nachhaltige Geldanlagen im deutschsprachigen Raum.

F.I.R.S.T. e.V.

Rentzelstr. 7

D-20146 Hamburg

Tel: +49 178 56 35 724

E-Mail: info@first-ev.org

Copyright © 2024 F.I.R.S.T. e.V. (Finance-Impact-Research-Sustainability-Transparency) | F.I.R.S.T. e.V.